|

MECHANICAL CASH BUILDER

Instantly download your copy of The Mechanical Cash Builder right away…

This is a professional grade trading system that takes full advantage of a secret hedge fund technique that is not only easy to use, it could put hundreds if not thousands of dollars in your pocket.

This is a gift to my community!

This is completely different from anything you’ve seen before and is yours today for absolutely ZERO cost. This has been responsible for many trading beginners finally making the breakthrough you’ve been looking for!

You will be supplied with everything you need – for zero cost – to start making hundreds of dollars today, including:

- The Secret Report containing the full system rules, the secret code and the instant cash-making strategies.

- The custom indicators that take advantage of this secret hedge fund technique, finely tuned to where the easy money is waiting.

- Plus you can watch my video on this page that shows you how to use this information to line your pockets with a ton of easy money.

- This system is a wealth generating machine that could practically print money for you… Day after day… Year after year. No need to buy anything or give your credit card.

INTRODUCTION

Welcome! You’re about to learn how to trade a system that has served me quite well for a very long time. I have every confidence that it will perform just as well for you if not better than it has for me.

When I was new to trading, I knew I was lucky to know about trading Forex because there are many people out there who still know nothing about it. I’m sure you can relate when I say Forex was a nightmare for me in the beginning, simply because I did not have a proper system or method to trade. I have blown many accounts and lost a lot of my money.

But because of that, I have learned a lot of good lessons. I now understand that in Forex there is no short cut. Every trader will experience the same things in trading the markets. We all need to learn how to trade properly in order to be successful.

The Mechanical Cash Builder trading system is quick to learn and easy to implement. If you are new to trading, this system is one of the best systems to start with because I use two simple indicators and a technique called divergence trading. I will show you how in great detail further in this report.

The currency pairs I usually trade are the EURUSD and GBPUSD, and if I don’t find a signal on these pairs, I will trade other currency pairs with low spreads or sometimes trade Gold instead.

I trade the most active currency pairs during any market session and the timeframes I normally use are the 15 minutes and 30 minutes. Sometimes I will trade on the 5 minute timeframe with adjusted targets when there is no signal on the higher timeframes.

In the following chapters you will learn more about my Mechanical Cash Builder trading system and learn exactly how I trade along with many examples and illustrations. It is my sincere hope that with this simple manual, I can help you improve the way you trade Forex.

COMPONENTS OF THE SYSTEM

Indicators

As I mentioned, I only use two indicators, which are the Exponential Moving Average (EMA) and Awesome Oscillator (AO).

Exponential Moving Average or EMA

Moving averages are computed averages of a specified number of candles to help smooth out price movement to show the current trend. It can also help predict support and resistance levels. The simplest moving average is the Simple Moving Average (SMA), which is the sum of the prices divided by the number of candles. All the prices are equal in weight for the SMA.

The type of moving average I use is the Exponential Moving Average (EMA). The main feature of this type of moving average is that it computes the weighted average of a set number of candles. It considers recent prices more important than the previous prices, so recent prices have greater weight. In other words, the EMA is more reactive to recent price movements.

I get a signal from the EMA if the price breaks above or below the line.

Awesome Oscillator

The Awesome Oscillator (AO) was developed by Bill Williams to show current market momentum and in form of a histogram, where each bar that is higher than the preceding bar is green while each bar that is lower than the previous bar is red.

It is basically the 34 SMA of the central points of the candles minus the 5 SMA of the central points of the candles.

The AO can be used in many ways as you can see below. They are well worth mentioning, but the only function used in this system is Divergence, which will be discussed in detail in the next page.

- Zero line crossovers Buy signal – histogram below the zero line crosses above the zero line. Sell signal – histogram above the zero line crosses below the zero line.

- Saucer Buy signal – oscillator is above the zero line and two descending red bars are followed by a green bar. Sell signal – oscillator is below the zero line and two ascending green bars are followed by a red bar.

- Twin Peaks Buy signal – histogram is below the zero line, it makes two troughs where the last low is higher than the previous low, and is followed by a green bar. Sell signal – histogram is above the zero line, it makes two peaks where the last high is lower than the previous high, and is followed by a red bar.

- Divergence Buy signal – histogram and price makes a bullish divergence signal. Sell signal – histogram and price makes a bullish divergence signal.

Divergence

Divergence occurs when the price moves in one direction while the indicator moves in the opposite direction, which indicates that the trend will change. In my system, I only use regular divergences.

Regular Bullish Divergence

A bullish divergence occurs when the price makes lower lows but the oscillator is making higher lows.

As you can see, Line A-B is drawn to connect a higher low and a lower low on the price going downwards, while line 1-2 connects a lower low and a higher low on the Awesome Oscillator going upwards. The price went up after the divergence occurred.

Bullish divergence indicates that momentum of the price movement in the downward direction is weakening and that the price may reverse soon. You must only enter when the reversal is confirmed.

Remember that the lines to identify a bullish divergence are drawn below both price and trendline, and the direction of the line on the indicator is going up even if the price is going down. Also, note that the price is making a lower low while the AO is making a higher low.

Regular Bearish Divergence

A bearish divergence occurs when the price makes higher highs but the oscillator is making lower highs. As you can see, line A-B is drawn to connect a lower high and a higher high on the price going upwards, while line 1-2 connects a higher high and a lower high on the Awesome Oscillator. The price went down as expected.

Bearish divergence means that the momentum of the price movement in the upward direction is weakening and that the price may reverse soon. You must only enter when the reversal is confirmed.

Support & Resistance

For my system, support and resistance levels are very important. Stop loss and take profit levels are based on such levels.

Generally speaking, support is the lowest maximum level that the price can reach. This is the level that price is unable to break any lower. The price stopped going down because the sellers are no longer willing to sell because it has become undervalued

On the other hand, resistance is the maximum high level that price can reach. Price is unable to increase anymore because the buyers are no longer willing to buy. They think that the value is overvalued.

There are major and minor types of Support levels. Major support and resistance levels are what we call bottoms and tops. They are the extreme lows and highs of the price. Minor support and resistance levels are levels within the range of the major levels that price was not able to exceed.

Take note that support (S) and resistance (R) can reverse roles. A previous support level can become a resistance level, as you can see in the image above.

Also, support & resistance are not areas because price can be affected by many factors, it does not necessary touch an exact price level. Having this in consideration, I set my stop loss a few pips below support (buy trades) or a few pips above resistance (sell trades) levels.

Common Chart Patterns Used

Double Tops/Bottoms

Sometimes, I will use Double Tops/Bottoms combined with EMA breakout for entry signals, especially when there’s no divergence.

As you can see in the image above, a double top occurred and the price went down.

Think of double tops as resistance levels and double bottoms as support levels that price respected.

Head & Shoulders

I also use the Head and Shoulders pattern as a confirmation to hold my position or to add another entry order.

The Head and Shoulders is a reversal pattern. In an uptrend, the price goes up making a swing high then pulls back, then it moves up again to make a higher high and pulls back again. Finally, it moves up again to form another swing high but it’s not as high as the second peak.

In the image below, you can see that the left shoulder is the first swing high, the head is a higher high, and the right shoulder is the third swing high that did not reach the level of the head. A line can be drawn to connect the swing lows to and this is called the neckline. When price crosses below the neckline, you get a sell signal.

The opposite is true for an Inverted Head and Shoulders pattern. The left shoulder is the first swing low, the head is a lower low, and the right shoulder is the third swing low that did not reach the level of the head. The neckline is drawn by connecting the swing highs and when price crosses above it, there is a sell signal.

In the example below, you have an Inverted Head and Shoulders pattern. After making the swing lows, it went up, crossed over the neckline and continued going up.

Pin Bar Candlestick

One important candlestick pattern I pay attention to is the pin bar or a candle with a long tail. Just like the previous patterns, it’s not required to enter a trade but it serves as a confirmation of my entry signal.

If a pin bar appears when divergence formed, it means that there is a very high probability that trend may reverse/retrace/pullback. The pin bar is often called “Pinocchio” bar. It is normally the turning point of price, so it seems to be protruding before price reverses.

CHART SETUP

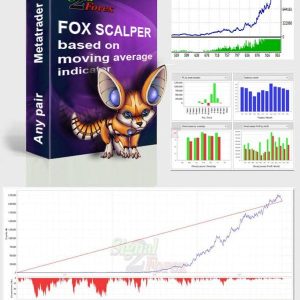

My trading charts are very easy to setup. As you can see in the image below, I only use two basic indicators, the 10 Period Exponential Moving Average and the Awesome Oscillator.

How to Setup Your Charts

First, open the EURUSD 15 minute chart, or any currency pair and timeframe you would like to trade. In the toolbar of the MT4 platform, click on the buttons for Candlesticks, Zoom In and Chart Shift. Right-click on the chart and select Grid. The chart is now ready for the indicators to be applied.

Properties, Colors Tab

In the chart properties, you should see the following settings under the Colors tab.

Take a look at this image:

Common Tab

Under the Common tab, only the Chart shift, Chart autoscroll, Candlesticks and Show OHLC are selected.

How to Setup Your Indicators

To apply the indicators, you can use the Indicators list in the Navigator window (click on “Ctrl” + “N” or click on the Navigator button above the chart). You can also use the Insert Menu at the top of the MT4 platform and select Indicators. You can watch my video on how to setup your charts and follow the steps.

1. Exponential Moving Average (10 EMA)

Apply the moving average to the chart by clicking on Insert on the main menu, then select Indicators. Click on Moving Average and enter the following in the parameters tab:

- Apply to – Typical Price (HLC/3)

2. Awesome Oscillator (OA)

To apply the Awesome Oscillator, open the Navigator window, double-click on Indicators to see the list, and double-click on Awesome Oscillator. Under the Colors tab, use Lime for Value Up, Red for Value Down, and select a thicker line for better visualization. Make sure that the Fixed minimum and Fixed maximum levels are not checked.

Now you’re ready to trade with my system.

BUY/LONG TRADE RULES

The rules of my system are easy to follow. All you have to do is look for divergence, enter a trade at the break of the EMA, and set the take profit and stop loss levels.

- Identify Regular Bullish Divergence by drawing a line connecting the lows of the price, and another line connecting the lows of the Awesome Oscillator (AO). On the price, connect the higher low (Point A) to the lower low (Point B). On the AO, connect the lower low (Point 1) to the higher low (Point 2).

- Although not required to be present to enter a trade, look for confirmatory signals:

a. Double Bottom

b. Triple Bottom

c. Inverted Head & Shoulders

d. Bullish Pin Bar at Point B

- Enter a buy trade when the price breaks above the 10 EMA and the AO turns green. Most of the time, I don’t wait for the candle to close, as long as the signals are valid and the price stays above the 10 EMA.

- Set the stop loss level a few pips below the lower low on price, which is below Point B. If no stop loss was set, cut any loss manually if the price breaks below Point B level.

- Set the take profit at the previous resistance (R) Level, or a little lower for safety.

Exceptions To The Rules

Even if there’s no divergence signal, if there is a double bottom, triple bottom, or an inverted head and shoulders pattern, enter a buy trade when price breaks above the 10 EMA.

Don’t trade during high impact news release.

BUY/LONG TRADE EXAMPLES

Buy/Long Example 1

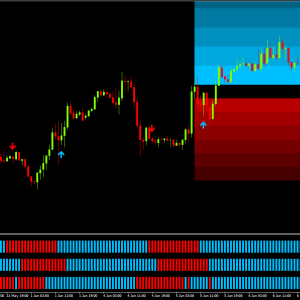

The price was making a lower low while the AO was making a higher low. This is a Regular Bullish Divergence, an early signal indicating that the price may retrace or reverse soon.

The AO has already turned green, so when the price broke above the 10 EMA, I entered a buy trade (1.35890) and set the stop loss level below point B (1.35600).

For me, the target is flexible; I will either set a fixed take profit or exit trade when price reaches the previous support/resistance level.

In this example, point R is the minor resistance level. A safe target number of pips must be smaller than the price range from the entry level to point R. I exited this trade at 1.36100 with about 21 pips of profit.

Buy/Long Example 2

In this example, the price was going down while the AO was making a higher low. You can see a pin bar near point B, which is a confirmatory signal.

The AO has turned green, so I entered a buy trade as soon as price broke above 10 EMA (1.37165) and set the stop loss level below point B (1.36835).

As usual, I set the target at Point R (1.37430), which is a minor resistance level. Not long after, I exited the trade with 26 pips.

SELL/SHORT TRADE RULES

Sell trades are entered in the exact opposite way as buy trades.

- Identify Regular Bearish Divergence by drawing a line connecting the highs of the price, and another line connecting the highs of the Awesome Oscillator (AO). On the price, connect the lower high (Point A) to the higher high (Point B). On the AO, connect the higher high (Point 1) to the lower high (Point 2).

- Although not required to be present to enter a trade, look for confirmatory signals:

a. Double Top

b. Triple Top

c. Head & Shoulders

d. Bearish Pin Bar at Point B

- Enter a sell trade when the price breaks below the 10 Exponential Moving Average (10 EMA) and the AO turns red. Most of the time, I don’t wait for the candle to close, as long as the signals are valid and the price stays below the 10 EMA.

- Set the stop loss level a few pips above the higher high on price, which is above Point B. If no stop loss was set, cut any loss manually if the price breaks above Point B .

- Set the take profit at the previous support (S) Level, or a little higher than the support level for safety.

Exceptions To The Rules

Even if there’s no divergence signal, if I see a double top, triple top, or head and shoulders pattern, I will enter a sell trade when price breaks below the 10 EMA.

Don’t enter a trade if high impact news is due to be released.

SELL/SHORT TRADE EXAMPLES

Sell/Short Example 1

On the EURUSD 5 Minute chart, the price made a higher high while the AO made a lower high. This is a Regular Bearish Divergence and indicates that the price may retrace or reverse soon.

The AO turned red, so when the price broke below the 10 EMA, I entered a sell trade (1.38033) and set the stop loss level a few pips above point B (1.38292).

Point S indicates a previous support level. A safe target number of pips must be smaller than the price range from the entry level to point S, so I exited this trade at 1.37789 with about 24 pips of profit.

Sell/Short Example 2

Here’s another example, this time, on the GBPUSD 15 Minute chart. The price made a higher high while the AO made a lower high, which is a Regular Bearish Divergence and indicates that the price may retrace or reverse soon.

As soon as the AO turned red and the price broke below the 10 EMA, I entered a sell trade (1.60407) and set the stop loss level a few pips above point B (1.60724).

I set the take profit a few pips above the previous support level indicated by Point S (1.60163).

I exited this trade with 24 pips of profit.

Download Mechanical Cash Builder

Frequently Asked Questions…

Q: How would you best describe your trading system?

A: It is a trend reversal system with entry positions against the trend, but with the help of divergence, the probability of trend reversal, trend retracement or pullbacks are high. This system can be used for scalping the 5 Minute charts, or intraday trading (15 and 30 Minute charts). Signals have more accuracy and the targets are much bigger on the higher timeframes. And with this system, I try to catch tops and bottoms while using a tight stop loss.

Q: How long have you been trading this particular trading system?

A: I have used this trading system for many years. Divergence and the EMA are the only signals in this system, so to increase the validity of the entry after signals, it will be of great advantage if you have knowledge on other trading techniques like chart patterns, candlestick patterns, trendlines and support/resistance levels. Applying all these concepts will make this trading system better.

Q: How much time each day, week or month are you able to dedicate to the various requirements of trading and managing a trading system?

A: I watch the market everyday using my desktop PC. If I need to step out I can always monitor my charts using my mobile phone or tablet. This system can be setup on your mobile phone without the need for custom indicators. I’m never far away from my trading platform in some form or another. I just make my entries when the signals meet my system’s conditions.

Q: How many trades do you expect to place each day, week or month?

A: It really depends on the market, I only trade according to the signals of my system. I don’t expect a specific number of trades each day, week or month because it will put me under pressure to spot these trades.

Q: Do you pay any attention to News releases or Fundamentals?

A: I avoid trading during high impact news releases because these may affect the market. So if there is any pending high impact news, I will wait until it’s over before looking for a trade setup.

Q: How does your system factor in the Fundamentals or News releases like the NFP, FOMC announcements?

A: It depends on the market situation. If I am in a trade I will monitor it closely and tighten my stop losses but I usually avoid trading during high impact news releases, especially NFP and FOMC, because the spikes that happen may easily hit my stop loss.

Q: Which kind of daily, monthly or weekly returns do you expect to make?

A: I prefer monthly returns because sometimes, you can make a mistake and can’t avoid a loss. So for me, what’s most important is to always make profit more than losses and be able to maintain a positive result every month. I aim to make between 50 to 100% a month.

Q: What timeframe/s do you trade and why?

A: The only timeframes I trade are the 5, 15 and 30 Minute timeframes. I am a short term trader, and lower timeframes make it easy for me to look for a trade setup or entry signal every day. You will find that this system does work well on higher timeframes too.

Q: Which session/s do you trade and why?

A: I will trade in any market session as long as my trading system rules provide me with an entry signal that meets all the conditions.

Q: Are there any currency pairs, timeframes or sessions that you avoid trading?

A: I only trade the currency pairs with low spreads and my most favourite pairs are the EURUSD and GBPUSD. I do not avoid trading during any specific session or timeframe but I always trade pairs that are active during these sessions. I prefer trading 5, 15 and 30 minute timeframe with this system and it is compatible with all currency pairs.

Q: Describe your daily trading routine.

A: I open the platform during the Asian session to check the market status. If I don’t find any entry signals I will wait until the European market is open to wait for an entry signal to emerge then open a position accordingly. Usually, the market will move in a small range or move sideways during the Asian session and the best trades are to be found during the European and US trading session overlap. I also check the news calendar every morning to alert myself when the high impact news releases occur. I trade mostly during the European & US sessions.

Q: What hardware, software and/or other tools do you use for trading?

A: I use my mobile, tablet and PC to trade and the platform I use is MetaTrader 4. The indicators I use in my trading can all be found in the MT4 platform or any other trading platform out there. I do not use any other software or tools with this trading system as they are not required. I designed this system to be easy to implement and something that can be traded while I am on the go.

Q: How did you come up with the system?

A: I came up with this trading system when I was trying to make a simple and easy trading method that can make profits consistently. For me the best indicators to do the job were the Exponential Moving Average and Awesome Oscillator.

Q: During what hours are you actively trading this system and why?

A: There are no specific hours for me to trade actively when using this system. I trade daily and usually monitor my charts up until the close of the European session. Afterwards I can always check my charts on my mobile devices if I am monitoring an open position or simply following the formation of a new setup on a different currency pair.

Q: Do you follow a set number of rules on each and every trade?

A: I will always follow the entry rules in order to open a position, but the target may vary. I will wait for the price to hit my target, and sometimes, I will move my stop loss to reduce the risk on the open trade.

Q: Are there any exceptions to your trading system rules?

A: Yes, I will trade when there is no divergence signal only if there is a valid chart pattern (Double Tops and Bottoms, Triple Tops and Bottoms, Head and Shoulders) and an EMA break. I don’t really focus on any other chart patterns so I only consider the Double Tops and Bottoms, Triple Tops and Bottoms, Head and Shoulders.

Q: Do you enter trades using market orders and/or pending orders?

A: I use both, but in most cases, I use market orders.

Q: If you use a pending order, how long do you wait before you cancel the order?

A: I will cancel the pending order when price fails to touch my pending order and started moving far from my pending order level.

Q: How do you determine the level/price where you will enter a trade?

A: I will enter a trade once the price breaks out of the EMA after the early signal of Bullish or Bearish divergence appears.

Q: What percentage of your account balance do you risk on each trade?

A: If I am looking to build a small account quickly I will risk 5% to 10% of my account balance on each trade. If I am trading a larger account I will only risk 1% to 2% of my account balance.

Q: What would be the maximum drawdown you would risk on any trade?

A: The maximum drawdown that I am willing to risk on any trade is 10% to 20% of my account balance.

Q: What is the maximum lot size that you would use to enter any particular trade on a $1000 account? What is the maximum number of trades that you open at one time?

A: The maximum lot size that I would use to enter any trade is 0.5 lots. I usually have only one trade open at a time.

Q: How long will you remain in a trade once it is opened?

A: I usually close my trades within the day.

Q: How do you determine the take profit level?

A: I place the take profit level few pips above the last swing low for sell/short trade, and place the take profit level few pips below the last swing high for buy/long trade. But usually, I aim for 5 to 20 pips if I entered based on the 5 minute timeframe, 10 to 50 pips based on 15 minute timeframe, and 20 to 80 pips based on 30 Minute timeframe.

Q: Do you place a stop loss level? If so, how do you determine this level?

A: I place a stop loss level a few pips above the current highest point for a sell/short trade, and vice versa, I place a stop loss level a few pips below the current lowest point for buy/long trade.

Q: Do you exit trades before your stop/target is hit?

A: Yes, sometimes, I just scalp for a few pips and get out of the market right away. At other times, I may choose to close my trades manually when price has reached my Take Profit level and appears to have stalled. In these cases I just prefer to exit the trade instead of risking watching the trade go against me.

Q: Which signals will cause you to exit early?

A: I exit early when I feel less confident and it seems very difficult for the price to hit my target.

Q: Are there any particular months or weeks that you prefer not to trade and if so why?

A: I choose not to trade during the end of December, because the spread of currency pairs go higher than normal and the market usually only moves in a small range or sideways.

Q: Would you consider your system to be easily understood by beginners, or is it better suited to intermediate or advanced level traders?

A: Yes, it is easy to understand for beginners. Additional knowledge of chart patterns and trendlines will give you an advantage when trading with this system.

Q: Does your method use any Channels, Chart Patterns or Candlestick Patterns?

A: My method does not use Channels. The chart patterns that I apply with my system are Double and Triple Tops/Bottoms and Head & Shoulders. Sometimes, I will use Double Tops/Bottoms and EMA break for entry signals when there is no divergence shown by the AO indicator. For Head & Shoulders, I will use this pattern as a confirmation to hold my position or to add another entry order. For example, let’s say I entered a buy trade due to a divergence shown by the AO indicator and the price broke the EMA and is going up, then after a moment, the price went down and broke below the EMA. In this situation, I will either wait for the price to hit my stop loss level or cut the loss when the price makes a new low. But if the price at this moment does not hit my stop loss or make new low, and instead, starts going up and breaks above the EMA again, then a pattern of Head & Shoulders is formed. For this reason, I will hold my position for more pips. Sometimes, I will also enter when I see the Head & Shoulders pattern and price breaks the EMA, even if there is no divergence.

The candlestick pattern I also pay attention to is the Pin Bar. It is a candle with a long tail, but it’s not really required in my entry rules. It just adds an advantage or serves as a confirmation of my entry signal if a pin bar appears when divergence formed. It means that there is a very high probability that trend may reverse/retrace/pullback.

CONCLUSION

By now you should have become more familiar with my Mechanical Cash Builder trading system. If you are completely new to trading the next step would be to open a demo account and test it for yourself to get a feel of how the system works. Go back to the history of your charts and have a look at previous signals. Practice identifying divergences.

If you feel you are used to identifying divergences, you can move a step further and practice looking for price patterns that can help you in making better trading decisions. Look for double tops/bottoms, head and shoulders patterns and pin bars.

Always trade the system according to the rules so that you will see actual unbiased results. Because the system is so simple to trade, it won’t be long before you will master trading with it. When you have gained consistent profits on Demo, that’s the only time you can start trading on a Live account to get a feel of live trading. Start small and work your way up. Patience is very important.

I do not believe there’s a secret of trading. But I believe if you learn as much as you can and trust yourself. Nothing is impossible. Self-discipline, a well-planned money management strategy and never giving up are important to be successful.

I hope my Mechanical Cash Builder system will help you achieve your goals in trading. And I hope you will enjoy trading it as much as I have enjoyed putting this system together.

Good luck! |