Your cart is currently empty!

CCI Expert Advisor

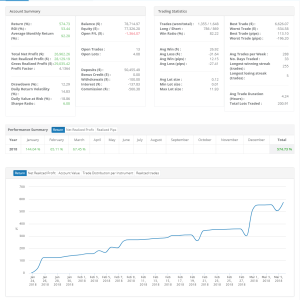

System: Metatrader 4 Need default Metatrader indicator: CCI Timeframe: H1 Currency pair: EURUSD Limits by accounts: No Broker account: any Type of trading: Middle-term automated tradingOptimization and forward period: 2015-2017Neural network: lightNumber of signals using in trading: 6 Moneymanagement: yesUsing with other EAs: yesBroker account: anyMax. spreads allowed: 2.1 (21)TakeProfit and StopLoss: automatic.Size of TakeProfit or StopLoss: from 30 till 200 pips depending on signals from robotTime of trading: adjustableLots: 0,01 – 100VPS or Laptop: need 24/5 […]

Description

|

System: Metatrader 4 Need default Metatrader indicator: CCI Timeframe: H1 Currency pair: EURUSD Limits by accounts: No

Broker account: any |

Moneymanagement: yes

Using with other EAs: yes

Broker account: any

Max. spreads allowed: 2.1 (21)

TakeProfit and StopLoss: automatic.

Size of TakeProfit or StopLoss: from 30 till 200 pips depending on signals from robot

Time of trading: adjustable

Lots: 0,01 – 100

VPS or Laptop: need 24/5 online

The CCI, or Commodity Channel Index, was developed by Donald Lambert, a technical analyst who originally published the indicator in Commodities magazine (now Futures) in 1980.

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

When the CCI is above +100, the price is well above the average price as measured by the indicator. When the indicator is below -100, the price is well below the average price.

A basic CCI strategy is to watch for the CCI to move above +100 to generate buy signals and move below -100 to generate sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occurs and then re-invest when the buy signal occurs again.

Related products

-

“FOX SCALPER” – FOREX EXPERT ADVISOR BASED ON MOVING AVERAGE INDICATORS.

$110.00 -

1M Scalping Forex Indicator

$19.99 -

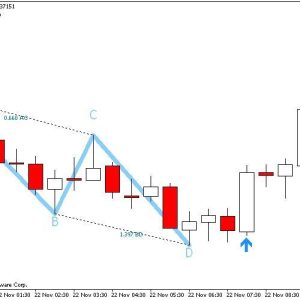

ABCD Retracement 6.0 – Metatrader Indicator (MT4/MT5)

$12.00 -

AF Scalper EA

Original price was: $38.00.$19.00Current price is: $19.00.