Your cart is currently empty!

TrendVision Pro System

TrendVision Pro System Content: Indicators: DSR_levels_alert.ex4, Indicador GVT.ex4, Timer-Best.ex4, Template: TrendVision Pro.tpl, How to install MT4 files.pdf TrendVision Pro : Forex Trading Strategy Forex trading can be challenging, especially for beginners who are still learning the basics. One way to improve your trading skills is to use technical analysis tools to help you identify potential trading […]

Description

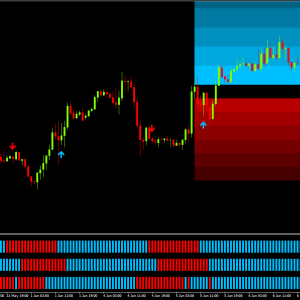

TrendVision Pro System

Content: Indicators: DSR_levels_alert.ex4, Indicador GVT.ex4, Timer-Best.ex4, Template: TrendVision Pro.tpl, How to install MT4 files.pdf

TrendVision Pro : Forex Trading Strategy

Forex trading can be challenging, especially for beginners who are still learning the basics. One way to improve your trading skills is to use technical analysis tools to help you identify potential trading opportunities. In this article, we will discuss a trading strategy based on two popular technical indicators, the Global Volume and Trend (GVT) indicator and the Dynamic Support and Resistance (DSR) Levels indicator.

What are the GVT and DSR Levels Indicators?

The GVT indicator is a technical analysis tool used to identify trends and measure volume in the forex market. It is based on a combination of moving averages and volume indicators, which allows traders to analyze the strength of a trend and potential reversals.

The DSR Levels indicator, on the other hand, is used to identify potential levels of support and resistance. This indicator plots horizontal lines on a chart based on recent price action, allowing traders to identify key levels where the price is likely to reverse or consolidate.

Using both indicators together can provide traders with a more comprehensive view of the market, allowing them to make more informed trading decisions.

Best Time Frame and Pair for this Strategy

The best time frame for this strategy is the 4-hour chart, as it provides a good balance between accuracy and speed. As for the best pair to trade, the strategy can be applied to any currency pair, but it is recommended to choose a pair with low spreads and high liquidity, such as EUR/USD, USD/JPY, or GBP/USD.

How to Trade Using the GVT and DSR Levels Indicators

Step: Identify the Key Support and Resistance Levels

The next step is to identify the key support and resistance levels using the DSR Levels indicator. Look for the horizontal lines that have been tested multiple times, as these levels are more likely to hold in the future. These levels can be used as potential entry and exit points for trades.

Step : Follow the Arrow Buy/Sell Signals

Once the trend and key support and resistance levels have been identified, look for the arrow buy/sell signals that appear on the chart. These signals are generated by the GVT indicator and indicate potential trend reversals.

If the arrow buy signal appears, it indicates a potential bullish reversal. Enter a long position at the key support level identified in and set a stop loss below the support level.

Conclusion

In conclusion, the GVT and DSR Levels indicators can be powerful tools for forex traders when used together in a comprehensive trading strategy. By identifying the trend, key support and resistance levels, and potential entry and exit points using arrow buy/sell signals, traders can make more informed trading decisions and improve their chances of success. However, it is important to always conduct your own research and analysis and to use proper risk management techniques to minimize potential losses.

Related products

-

‘Kernel Density’ Market Tops & Bottoms Indicator

Original price was: $99.00.$16.00Current price is: $16.00. -

‘Pop Out Of The Box’ Pattern by Doug Campbell

$49.00 -

“FOX SCALPER” – FOREX EXPERT ADVISOR BASED ON MOVING AVERAGE INDICATORS.

$110.00 -

“Kaizen ON-DEMAND Apprenticeship” by Steve Nison

Original price was: $895.00.$200.00Current price is: $200.00. -

“Trade Predator” By Tradeology

$7.00